Complaints Policy

Overview

This is the official Complaints Resolution Manual implemented for CAPITAL LEGACY SOLUTIONS (PTY) LTD.

Purpose

The Financial Advisory and Intermediary Services Act (FAIS Act) requires that a financial service provider (i.e. our company) must maintain an internal complaints resolution system and procedure in the event that a customer complains about a financial service rendered by the financial services provider.

Treating Customers Fairly (TCF) Outcome 6 provides that “Customers do not face unreasonable post-sale barriers imposed by firms to change product, switch providers, submit a claim or make a complaint”.

This document not only provides a complaints procedure in conformance with legislative expectations but it also explains the procedure should you wish to complain about any of the financial services rendered by our company, and sets out the process which our company will follow in order to resolve the complaint.

Objectives

- To deliver consistent, high-quality and accountable responses to complaints received, across CAPITAL LEGACY.

- To ensure that our complaints procedure is in line with the overall regulatory requirements and Treating Customer Fairly outcomes and industry ‘best practices’.

Services Covered

CAPITAL LEGACY provides non-automated advice services in Category 1 Long-Term Insurance. Therefore, the scope of the resolution process will pertain to such services rendered.

Document Control

The Compliance Department will be responsible for updating the document.

Complaints Manager

Name: Natasha Thysse

Tel No: +27 87 352 2848

Department: Life Info

Fax: N/A

Email:

complaints@capitallegacy.co.za

Definitions

1. “Complainant” means a person who has submitted a specific

complaint to the financial services provider or its service provider and who:

a) is a

customer or prospective customer of the financial services provider concerned; and

b) has a

direct interest in the agreement, product or service to which the complaint relates; or

c)

has submitted the complaint on behalf of a person mentioned in (a),

provided that a prospective customer will only be regarded as a complainant to the extent that the complaint relates to the prospective customer’s dissatisfaction in relation to the application, approach, solicitation or advertising or marketing material contemplated in the definition of “prospective customer”.

2. “Complaint” means an expression of dissatisfaction by a

complainant, relating to a product or service provided or offered by the financial services

provider, or to an agreement with the financial services provider in respect of its products or

services and indicating that:

a) the financial services provider or its service provider has

contravened or failed to comply with an agreement, a law, a rule, or a code of conduct which is

binding on the financial services provider or to which it subscribes;

b) the financial

services provider or its service provider’s maladministration or wilful or negligent action or

failure to act, has caused the complainant harm, prejudice, distress or substantial

inconvenience; or

c) the financial services provider or its service provider has treated the

complainant unfairly,

and regardless of whether such an expression of dissatisfaction is submitted together with or in relation to a customer query.

3. “Customer” of a financial services provider means any user, former user or beneficiary of one or more of the financial products or services provided by the financial services provider, and their successors in title. This term may be used interchangeably with Client, within Capital Legacy documentation.

4. “Customer Query” means a request to the financial services provider by or on behalf of a customer or prospective customer, for information regarding the financial products, services or related processes, or to carry out a transaction or action in relation to any such product or service.

5. “FAIS” means the Financial Advisory and Intermediary Services Act No. 37 of 2002 which was designed to protect customers of financial services providers; regulate the selling and advice-giving activities of the FSP (FSPs); ensure that the consumers are provided with adequate information about the financial product they use and about the people and institutions who sell these financial products and establish a properly regulated financial services profession.

6. “FAIS Ombud” the FAIS Ombud deals with complaints submitted to the Office by a specific customer against a financial services provider.

7. “Financial Services Provider” means CAPITAL LEGACY SOLUTIONS (PTY) LTD with FSP Number 43826 and place of business as 1st Floor, Roland Garros, The Campus, 57 Sloane Street, Bryanston, 2129.

8. “Prospective customer” of a financial services provider means a person who has applied to or otherwise approached the financial services provider in relation to becoming a customer of the financial services provider, or a person who has been solicited by the financial services provider to become a customer or has received marketing or advertising material in relation to the financial institution’s products or services.

9. “Routine Complaints” is where a customer submits an expression of dissatisfaction together with a customer query or relating to a customer query and which further can be resolved internally within a period of fifteen (15) days. Routine complaints are therefore customer queries which have been previously escalated by the customer but now the customer has become dissatisfied with the process being followed to resolve the customer query.

10. “Serious Complaints” are complaints that contravene regulatory requirements and are likely or may already have caused a customer to suffer financial prejudice.

11. “Service provider” means another person with whom the financial services provider to whose products or services the complaint relates has an arrangement in relation to the marketing, distribution, administration or provision of such products or services, regardless of whether or not such other person is the agent of the financial services provider.

12. “Resolved” in relation to a complaint means that the complaint has been finalised in such a manner that the complainant has explicitly accepted that the matter is fully resolved or that it is reasonable for the financial services provider to assume that the complainant has so accepted. A complaint should only be regarded as resolved once any and all undertakings made by the financial services provider to resolve the complaint have been met.

13. “TCF” Treating Customers Fairly is an outcome-based regulatory and supervisory approach designed to ensure that specific, clearly articulated outcomes for fairness regarding financial services to customers are delivered on by regulated FSPs. Financial Service Providers are expected to demonstrate that they deliver the required six (6) TCF Outcomes to their customers throughout the product lifecycle, from product design and promotion, through advice and servicing, to complaints and claims handling – and throughout the product value chain.

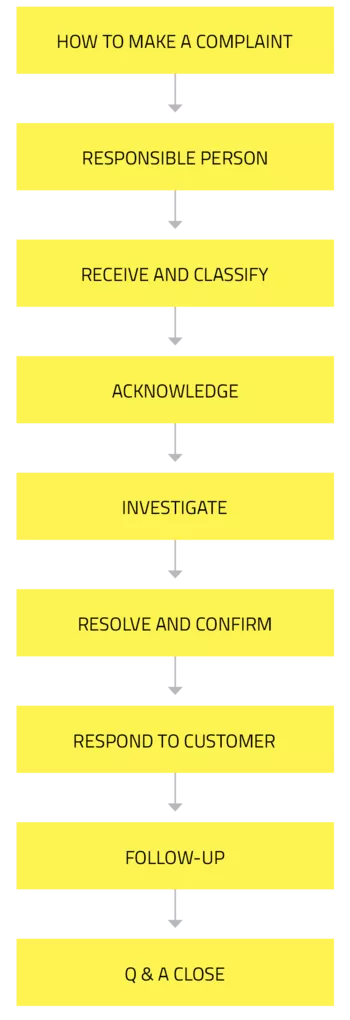

Process Overview

The following key steps must be followed for all customer complaints received by the staff of CAPITAL LEGACY.

The requirements for each step are detailed below.

Process

1. How to make a complaint?

1.1. If you as a customer or prospective customer have a complaint against our

company, it must be submitted to us in writing. It can be submitted either by hand, post, fax or

email at the contact details that appear in this document.

1.2. You should provide

sufficient detail of the complaint including policy number details.

1.3. We will keep a

record of the complaint and maintain such record for five (5) years as required by legislation.

2. Who will handle your complaint?

2.1. Once your complaint has been received it will be allocated to and dealt with by

adequately trained staff.

2.2. The person responsible for your complaint will furnish you

with his/her contact details and the reference number of your complaint (if applicable).

2.3. The Complaints Manager will have oversight over the complaints allocated to various

personnel and you may direct any queries to the Complaints Department (Life Info) whose details

are recorded in this document.

3. Receive and classify

3.1. We will ensure that all potential issues are captured and classified for

escalation, review and action as required.

3.2. Any complaint, issue or negative customer

interaction must be reduced to writing and must be logged and classified for action.

3.3. A

third party acting on behalf of a complainant must deliver a certified or original consent or

power of attorney to act on behalf of a complainant. Should such third party fail to deliver a

consent or power of attorney, no further dealings will be pursued with such third party until

the proper authority is obtained. The complaint will however be taken up directly with the

complainant on whose behalf the complaint is made.

3.4. All complaints must be formally

logged using the following system: email/letters/telephonic calls.

3.5. Risk

All complaints will be prioritised as follows:

3.5.1. Risk 1 – routine complaints with potential low business impact. This requires a response to the customer within fifteen (15) working days.

- Routine complaints have the potential of becoming serious or official complaints should they be disregarded or ignored by a financial services provider.

- The staff member logging the complaint should review the complaint and its priority with the Complaints Manager before proceeding to the next step.

- The Complaints manager will decide on the appropriate person(s) to carry out subsequent steps, including the investigation.

3.5.2. Risk 2 – urgent with serious business impact. This requires a response to the customer within five (5) to ten (10) working days.

- Serious complaints are complaints logged on media platforms, received from legal advisors or immediately evidence contravention of legislation requirements such as failure to conduct a proper needs analysis.

- These complaints from the outset may cause reputational harm to a financial services provider and/or may cause financial loss to a customer.

- These complaints should ideally be handled by the Complaints Manager/Key Individual or suitable senior person delegated to the task by the Complaints Manager/Key Individual.

- Complaints from third parties and/or legal advisors will be responded to within 24 hours, acknowledging receipt of the complaint and further requesting authority to act on the complainants behalf such as a power of attorney or consent by the complainant to deal with the complaint on the complainant’s behalf.

- No information will be divulged to a third party who does not have the proper authority to act on a complainant’s behalf.

3.5.3. Risk 3 – urgent official complaints received from regulators, e.g. FAIS Ombud. The regulator usually stipulates a response time of thirty (30) days from receipt of the complaint.

- Official complaints should be handled by the Complaints Manager/Key Individual.

- The investigation of the complaint may be delegated to a suitable senior person selected by the Complaints Manager and the required draft response and attachments may be collated by such senior person.

- The Complaints Manager will be ultimately responsible for compiling the response to the regulator.

- The response to the Regulator should be made within the stipulated turnaround time.

3.6. Categorisation

- Complaints will be categorised according to their nature, e.g. service, product related, features, performance, advice given, etc.

The complaints are then further categorised by their impact on the customer. The impact of a complaint is measured by further categorising it according to the following TCF Outcomes:

- TCF Outcome 2 – These are complaints relating to the design of a product or service. The categories which affect TCF Outcome 2 would be product features and charges.

- TCF Outcome 3 – These complaints relate to unsuitable or inaccurate, misleading, confusing or unclear information provided to a customer throughout the lifecycle of a product. This could vary from advice, product information, information provided in advertising or marketing material about a product or service rendered, etc. These disclosures would include the conflict of interest disclosures required by the General Code of Conduct of FAIS (Code); Section 4 and 5 of the Code or any other disclosure requirements in terms of the Code or any other legislation.

- TCF Outcome 4 – These are complaints which relate to the advice given to a customer by an advisor which was misleading, inappropriate and/or tainted with conflicts of interest which were not disclosed. Inappropriate advice given as a result of lack of knowledge, skill or experience on the part of the advisor of the product or service being rendered, would also be included here. The failure to conduct a needs analysis and to consider the customer’s financial position, goals or life stage would also amount to a contravention of suitable advice requirements and any complaint in association herewith would fall into this category.

- TCF Outcome 5 – Complaints in this category pertain to product performance and service-related issues. This would include complaints relating to a customer’s disappointment with limitations in a product or service performance of which they were unaware as well as the inability of a product to meet a customer’s expectations. Complaints related to a product supplier’s exercise of a right to terminate a product or amend its terms, would also be included in this category.

- TCF Outcome 6 – These complaints relate to product accessibility, changes or switches, complaints relating to complaints handling and complaints relating to claims would be categorised here.

Other categories may be developed which are appropriate to this outcome and will be incorporated into the policy and attached complaint register.

4. Acknowledge

4.1. All complaints must be acknowledged within 24 hours of receipt.

4.2. Where

an acknowledgement is made telephonically it will be followed up with a written response whether

by SMS or email.

5. Investigate

5.1. The investigation will be driven by analysing the root cause of the complaint

to enable the complaint to be appropriately dealt with and to avoid, if possible, its

reoccurrence.

5.2 This may require that both internal and external key facts are identified

and clarified.

5.3. Should a complaint relate to product features or services handled solely

by a product supplier, this matter will be escalated and appropriately dealt with in conjunction

with the product supplier, ensuring that the matter is resolved to the satisfaction of the

complainant.

5.4. All areas of interaction and communication will be documented and where

appropriate, consent obtained from the complainant to ensure that no personal information is

divulged or processed without the complainant’s knowledge or consent.

5.5. During the

investigation process the complainant will be kept appropriately updated on the progress of the

investigation.

6. Resolve and confirm

6.1. Ensure that the proposed resolution meets Treating Customer Fairly Outcomes,

does not prejudice the financial services provider or complainant, and does not involve any

unnecessary legal or financial implications.

6.2. The proposed action will be documented and

discussed and agreed upon with the Complaints Manager and/or affected Key Individual and

Representative.

6.3. The signed-off resolution will then be discussed and reviewed with the

complainant to ensure fairness and clarity and to further ensure that the resolution deals with

the root cause of the complaint.

6.4. The review should include recognition and

documentation of any underlying issues that have contributed to the complaint and

recommendations for actions to prevent further occurrence.

7. Respond to Customer

7.1. The details of the findings and proposed resolution should be clearly explained

(in written or verbal form as appropriate) to the customer, within the agreed timescales.

7.2. Where a complaint cannot be addressed within three (3) weeks by the financial services

provider, it must as soon as reasonably possible after receipt of the complaint, send to the

complainant a written acknowledgment of the complaint with contactable references of the FAIS

Ombud.

7.3. If within six (6) weeks of receipt of a complaint, CAPITAL LEGACY has been

unable to resolve the complaint to the satisfaction of a complainant, the complainant may:

- refer the complaint to the Office of the FAIS Ombud if he/she wishes to pursue the matter; and

- the complainant MUST do so within six (6) months of receipt of such notification.

8. Follow up and Review

8.1. Complaints will be diarised to ensure it remains within the appropriate

turnaround times.

8.2. Should a complaint exceed the turnaround time due to unforeseen and

reasonable circumstances, the complainant will be kept appropriately informed of the reasons for

the delay and a speedy resolve will continuously be sought.

8.3. A complainant will be kept

appropriately informed throughout the complaints process of the resolution being sought.

8.4. Upon resolution of the complaint another follow-up will be conducted to ascertain whether

the customer was satisfied with the complaints handling process and the resolution sought and

whether the resolution was proper and fair.

8.5. Any negative responses will be actioned in

the quarterly review of complaints.

9. Quality Assurance and Close

9.1. The Complaints Manager will ensure that all employees of CAPITAL LEGACY have

access to the complaints resolution manual.

9.2. Customers will be made aware of the

complaints resolution manual and will have access to the manual upon request.

9.3. All

complaints will be reviewed quarterly and would be further utilised as TCF Management

Information utilised to improve overall TCF outcomes.

9.4. All complaints will be actioned

with the aim of preventing reoccurrence, where feasible.

Important Contact Details

Capital Legacy Solutions

Post: Private Bag X3, Bryanston, 2021

Email: lifeinfo@capitallegacy.co.za

Online submission:

https://www.capitallegacy.co.za/contact-us/

Telephone: 087 382 2800

Guardrisk Life Limited

Post: PO Box 786015, Sandton, 2146

Telephone: 011

669 1000

Email: complaints@guardrisk.co.za

The Ombudsman for Long-term Insurance

Post: Private Bag X45, Claremont, 7735

Telephone: 021

657 5000 / 086 010 3236

Fax: 021 674 0951

Email:

info@ombud.co.za

The Financial Sector Conduct Authority (FSCA)

Post: PO Box 35655, Menlo Park, 0102

Telephone: 012

428 8000

Fax: 012 346 6941

Email:

info@fsca.co.za

The FAIS Ombudsman

Post: PO Box 74571, Lynnwood Ridge, 0040

Telephone: 012

762 5000

Fax: 012 348 3447

Email:

info@faisombud.co.za