- Kenrick Newport

- June 2, 2022

Nearly a million South Africans live abroad - but how does that affect their wills?

In this article, Ken Newport, delves into the interesting topic of emigration. We find out how the number of South Africans leaving the country is ever increasing and what effect this has on the Wills which they have drafted in South Africa. Ken explains the difference between Local, Offshore and Worldwide Wills. Moreover, he discusses the validity of these Wills in foreign countries and shares insight into the importance of understanding the jurisdiction of the country which you are moving to, with regard to inheritance tax. This will ensure that you do not incur unforeseen expenses and that the Estate will be looked after in accordance with your wishes.

Between 2015 and 2020 more than 128 000 people have emigrated from South Africa. To put it in perspective, this is more people than the whole population of Mbombela (Nelspruit), the capital of Mpumalanga.

It is also three times as many people who emigrated from South Africa between 2010 and 2015 (43 000 people).

By the end of 2020 the number of South Africans living in other countries and territories, numbered 914 901. That is according to the UN Department of Economic and Social Affairs’ 2020 International Migrant Stock report.

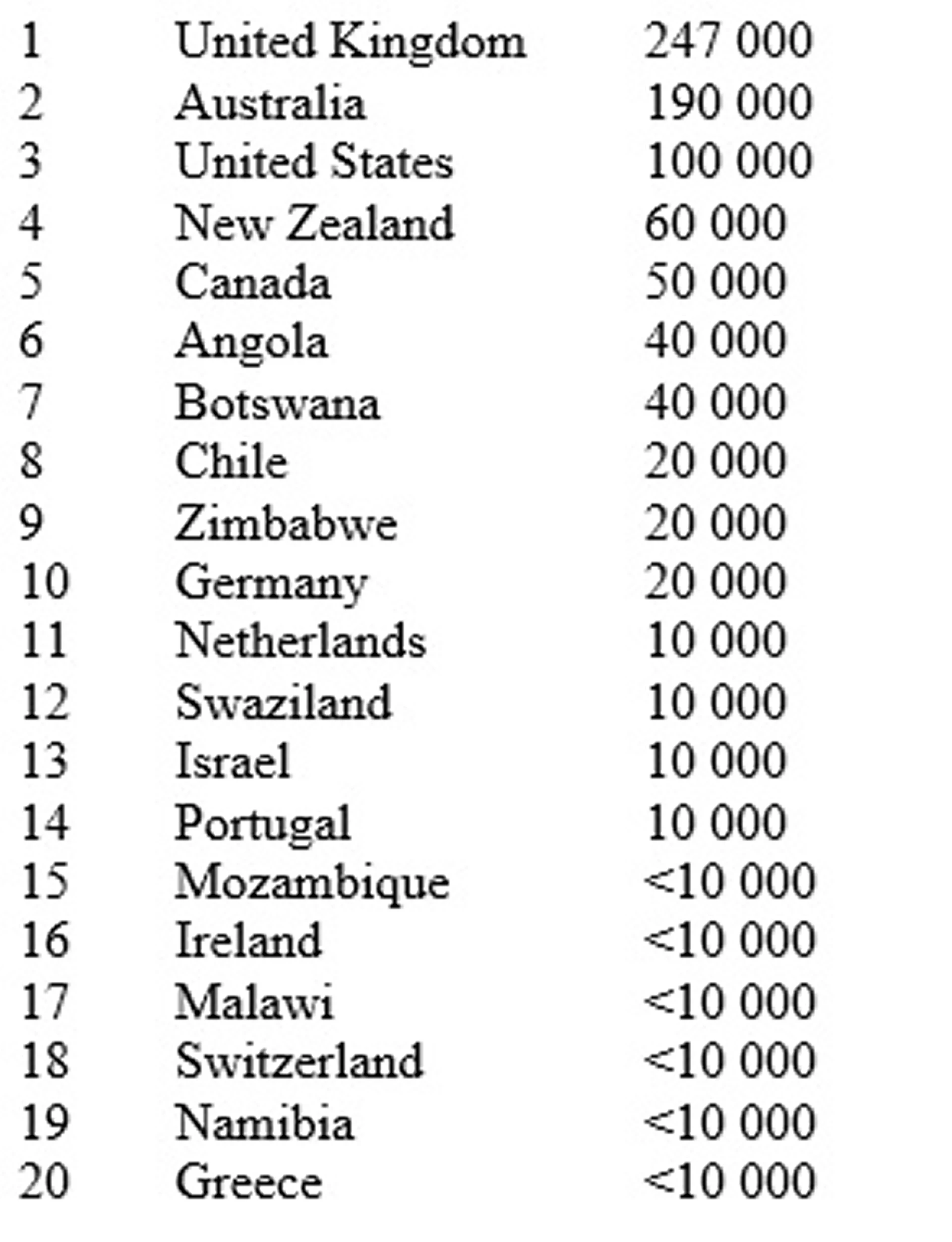

The vast majority settled in the United Kingdom (around 247 thousand), followed by Australia (nearly 200 thousand). Together, the two countries constituted roughly 49 percent of the total South African migrants living abroad. The third major country of destination for South Africans was the United States, with about 117 thousand people living there. Overall, the 20 countries presented, covered more than 90 percent of all South African migrants.

Top 20 countries South Africans have emigrated to:

The quest for stability.

South Africans seem to favour the political, economic, and social stability of countries like Australia, New Zealand, Canada, and most of Europe. With the current political climate in South Africa, more and more of its citizens are preparing for the next 10 years by securing residency in these countries.

One of the best ways to secure residency in a country abroad is to buy a property in that country. And, when one buys property, you should update you Last Will and Testament.

Your Last Will and Testament gives instructions to the appointed Executor on how you wish for your Estate to be distributed after your death. In other words, who will inherit what.

So, let us look at Wills when dealing with international assets.

Wills are divided into three categories when dealing with international assets:

Local Wills

A local Will refers to a Will drawn up in the country of your residence, and it gives instruction on what should happen to the assets in your country of residence, should you pass away. Often, within a local Will you will find a clause stating that all other Wills should be disregarded (revoked) and that this Will should be considered as the only legal and valid Will. This is generally fine unless you have international assets that you have not provided for in a Will and for which you may have drafted a Will within another jurisdiction.

Worldwide Wills

Worldwide Wills are a convenient, “single-Will” approach for those with offshore assets as they include what should happen to the international assets you may have. It is important to note that your Worldwide Will only legally covers assets in countries which observe Common Law, as South Africa does, when it comes to inheritance.

In South Africa, we have freedom of testation, which means that, apart from a few laws that ensure children and spouses’ protection and provision, you may pass your legacy on to whomever you choose through your Will. As mentioned, South Africa observes Common Law when it comes to inheritance. So do a few other countries that have been influenced by British Common Law. This is applicable in countries such as the United Kingdom, Australia, New Zealand, and parts of Canada, India, and Singapore. Assets you may own in these countries would form part of your Worldwide Will.

Offshore Wills

If you own assets in a country that does not have the same inheritance laws as SA, you will need to draft an Offshore Will for the assets in the country with the different inheritance laws. This is in addition to your local South African Will.

For example, suppose you have assets in countries such as France, Spain, Italy, Portugal, or certain parts of Canada, where Civil Law is observed. There are very specific laws with regards to inheritance, and forced heirship applies in those countries. Forced heirship means you do not have much control over who will inherit the assets you have within these jurisdictions and your Offshore Will must make provision for that country’s specific laws on inheritance.

The following principles might also help to shed more light on how to make sure you have the correct Last Will and Testament if you have assets abroad.

Accidental (implied or tacit) revocation concerning wills

The simplest method of revoking a Will is by validly executing a further Will or Codicil. A clear way of doing this is by including a revocation clause in the later Will. An example is: “I revoke all former Wills and Testamentary dispositions and declare this to be my Last Will and Testament”. This simple clause will revoke all previous Wills and Codicils.

But this clause might present problems when acquiring foreign assets in countries which don’t have testamentary freedom. Testamentary freedom, as we have in South Africa, simply means that the Testator may leave his Estate to whomever he wants to. In some countries, for example France, the principle of forced heirship applies. Under the laws of forced heirship children are prioritised above spouses.

Why should this be a problem? Well, let us assume that a South African buys a property in France. He then draws up another Last Will and Testament to leave the property in France and his properties in South Africa to his wife. But the property in France might end up going to his children, because of France’s laws of forced heirship which prioritise children above spouses.

How could this happen? Simply because the Last Will and Testament is subjected to the laws of the country where the asset is situated.

That part of the Testator’s Will is thus accidentally revoked.

How the European Succession Regulation no. 650/2012 (Brussels IV) concerning Estates helps to prevent accidental revocation

Many countries in Europe, such as France, Spain, Germany, and Italy restrict testamentary freedom through their forced heirship rules, which can potentially provide statutory or fixed shares to certain family members.

This means that in some cases, a South African individual with assets in certain European countries may be restricted as to whom they can leave their assets to. However, where a South African individual owns assets located in the European Union (the UK, Ireland, and Denmark excluded), the European Succession Regulation No. 650/2012 (also known as Brussels IV) presents a very useful planning opportunity.

Brussels IV enables an individual to elect for the law of their nationality to apply to the succession of their assets. This can, potentially, be a convenient way to avoid the forced heirship rules and, for a South African national, ensure that South African law applies to the succession of the European assets.

Both the EU citizen and the non-EU citizen may choose the law of his country or nationality to apply to his Estate. The default position is that the governing law of the state in which the deceased was habitually resident at his death will be utilised for the distribution of the deceased’s Estate.

Brussels IV applies to deaths on or after 17 August 2015.

The signatory states are Austria, Belgium, Bulgaria, Croatia, Cyprus, the Czech Republic, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Spain, Slovakia, Slovenia, and Sweden.

So, if you’re contemplating purchasing a property abroad or have emigration in mind, remember to consider the implications on your Will.

Chat to Capital Legacy for expert advice on securing your offshore assets. We have helped draft nearly 380,000 Wills over the past 10 years and we will assess your wishes and Estate needs and advise you on the best route to take.

Whether you’re in need of a

will, life insurance, education

cover,

or the power of all three, we have got you covered.